Whitepaper: Tax Efficient Investing [Updated Jan. 2024]

InCommercial announces the released update of its whitepaper titled: Tax Efficient Investing – Maximizing the Efficiency of Depreciation.

The whitepaper discusses tax-efficient investing using bonus depreciation, applicability, and usage in today’s market.

Written by Erik Conrad, CEO of InCommercial Property Group.

Download Whitepaper: Tax Efficient Investing [Updated Jan. 2024]

Introduction:

Continuing in the path of 2022 and 2023, 2024 is anticipated to be a difficult time to be an investor in any asset class. Inflation, the great destroyer of wealth, is receding with prices still high along with uncertain economic conditions. Taxes, always a concern for the sophisticated investor, seem only set to rise. That challenging backdrop is met with potentially falling corporate profits, stock market volatility, and declining rental rates in many markets.

To excel in 2024, an investor will have to make smart choices to invest in assets that produce durable income, backed by strong companies in resilient industries while being mindful of how to protect those gains from today’s challenges – including dilution from rising taxes.

Read the full whitepaper HERE: Tax Efficient Investing [Updated Jan. 2024]

Disclaimer:

InCommercial Property Group and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. As mentioned throughout this presentation you should consult with competent, independent, tax representation before engaging in any transaction.

Whitepaper: Market Opportunities

InCommercial announces the release of its latest whitepaper titled: Market Opportunities – Capitalizing on Current Conditions while Hedging Risks.

The whitepaper discusses build-to-suit development strategy, key risks, opportunities, and underwriting in today’s market conditions.

Written by Erik Conrad, CEO of InCommercial Property Group.

Download Whitepaper: Market Opportunities

Introduction:

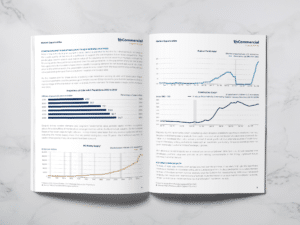

A “Build to Suit” or “BTS” development is one wherein a commercial property tenant enters into an agreement with a developer or landowner to construct a new, purpose-built facility for the tenant tied to a long-term lease commitment from the tenant once completed. Build to Suit development opportunities are historically amongst the market’s most popular as well as the most limited investment opportunities. Once an investor understands and appreciates the nature of a build to suit development cycle it becomes apparent why, particularly in bull markets, the opportunity to invest in the build to suit space is limited to long-term market insiders.

Build to Suit developments seek to eliminate the speculative variables that accompany most development projects with the largest and most obvious being entitlements and lease-up. The additional certainty from eliminating these substantial risks compresses the development timeframe and drives attractive annualized returns comparable (on an IRR basis) to more speculative investments.

Sophisticated institutional investors and lenders have traditionally crowded out individual investors in this sector because of the high relative risk-adjusted returns and predictable, repeatable business opportunities afforded. The recent monetary tightening, combined with the persistently slower velocity of capital within the commercial real estate market (a result of the Federal Reserve’s efforts to reduce inflation), has resulted in opportunities for investors to capture a share of this attractive development sector and secure long-term gains that are not generally otherwise available.

Read the full whitepaper HERE: Market Opportunities

Whitepaper: Tax Efficient Investing

InCommercial announces the release of its latest whitepaper titled: Tax Efficient Investing – Maximizing the Efficiency of Depreciation.

The whitepaper discusses tax-efficient investing using bonus depreciation, applicability, and usage in today’s market.

Written by Erik Conrad, CEO of InCommercial Property Group.

Download Whitepaper: Tax Efficient Investing

Introduction:

Continuing in the path of 2022, 2023 is thus far proving to be a difficult time to be an investor in any asset class. Inflation, the great destroyer of wealth, is proving stickier and far less “transitory” than anticipated, and taxes, always a concern for the sophisticated investor, seem only set to rise. That challenging backdrop is met with potentially falling corporate profits, stock market volatility, and declining rental rates in many markets.

To excel in 2023, an investor will have to make smart choices to invest in assets that produce durable income, backed by strong companies in resilient industries while being mindful of how to protect those gains from today’s challenges – including dilution from rising taxes.

Read the full whitepaper HERE: Tax Efficient Investing

Disclaimer:

InCommercial Property Group and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. As mentioned throughout this presentation you should consult with competent, independent, tax representation before engaging in any transaction.

Whitepaper: The Case for NNN-Leased Investments

InCommercial announces the release of its recent whitepaper titled: The Case for NNN-Leased Investments in Your Portfolio.

The whitepaper discusses the one asset class that is the most predictable and durable – long-term, single-tenant, absolute triple net-leased properties with an investment-grade guarantor.

Written by James G. Shaw, President at InCommercial Property Group.

Download Whitepaper: The Case for NNN-Leased Investments

Introduction:

When I tell people that at InCommercial Property Group we focus primarily on triple net properties, leased on a long-term basis with an investment-grade guarantor, they often tell me that they are boring, and not “sexy.” Okay, fair enough, but investors, particularly 1031 Exchange investors, are increasingly seeking predictable and durable income as their investment property of choice, especially in today’s turbulent and unpredictable economic environment.

When viewed objectively, there can be no doubt that the one asset class that is most predictable and durable is long-term, single-tenant, absolute triple net-leased properties with an investment-grade guarantor.

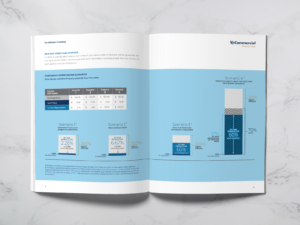

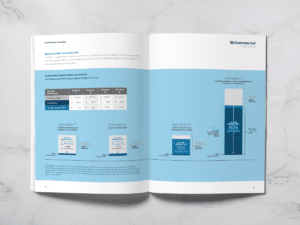

CCIM Institute Lease-Default Analysis:

The CCIM Institute published a lease-default analysis of 100 single-tenant, net-leased deals consisting of 70 investment-grade and national tenants and 30 franchisee, regional and local tenants located nationwide. Of the 70, no investment-grade tenants defaulted on their leases (0.00%) and only one national tenant defaulted (1.43%). Of the 30 franchisee, regional, and local tenants, five defaulted (16.67%) (1).

A 40-year study by Standard & Poor’s of corporate bond defaults between 1981 and 2021 (which included several recessions, including the Great Recession) found that corporations with an investment-grade rating experienced bond defaults at a rate of only 0.075% per year (2).

InCommercial Portfolios of Triple Net Lease Properties:

Looking at the portfolios of triple-net properties leased to tenants with an investment-grade guarantor owned and/or managed by InCommercial, there have been zero tenant defaults and zero mortgage defaults. Even during the peak of the pandemic, with the economy at a virtual standstill. We experienced 100% collection of contracted rents in our portfolios of net-leased properties with investment-grade guarantors (3). We are not aware of any other real estate asset class that can make a similar claim.

National Multi Housing Council Study:

For comparison, the National Multi Housing Council conducted a study of more than eleven million apartment units between April 2019 and December 2021 (4). They found that for occupied units, during all of 2021 (when the pandemic was waning) 22.1% were at least six days late in paying rent and 6.00% did not pay their rent at all in each month. Add that to the actual or projected vacancy rate and even an asset class perceived to be as low risk at apartment properties is not quite as predictable in its income stream as investment-grade, triple-net leased properties.

Predictable and Durable:

The predictable income streams of investment-grade net-leased properties are also durable. Typical lease terms for these properties range from 10 to 25 years and almost always contain tenant-controlled options to renew for multiple terms, potentially creating generational income streams. The net operating income from these properties is equally predictable as the tenants pay all expenses, including repairs and maintenance in an absolute net lease like those that make up most of the properties in our portfolios.

But what happens when single-tenant, net-leases do mature (expire)? InCommercial has managed more than one hundred lease maturity events (5). Of those we had ninety-nine successful renewals with an increase in rent; one non-renewal where the property was sold at a profit; one non-renewal that was re-tenanted and still owned; one non-renewal sold at a loss; and one non-renewal which is vacant and still owned.

Unpredictable and flashy may be exciting to some. So, label us boring if you wish but predictable certainty makes for a good night’s sleep and happy investors. Frankly, in today’s economic environment, that is just fine with us.

Download the full whitepaper HERE: The Case for NNN-Leased Investments

Sources:

(1) https://www.ccim.com/cire-magazine/articles/323688/2014/11/net-leased-single-tenant-risks/

(2) https://www.maalot.co.il/Publications/TS20220424121828.PDF

(3) InCommercial Property Group Portfolio Data

(4) https://www.nmhc.org/research-insight/nmhc-rent-payment-tracker/

(5) InCommercial Property Group Portfolio Data