InCommercial Launches Motor Fuel Fund III Offering

InCommercial Launches Motor Fuel Fund III Offering

InCommercial Capital Corporation announced its newest limited partnership offering: InCommercial Motor Fuel Fund III, LP. The fund is seeking to raise $50 million from investors who are interested in the potential for tax advantages through the effective use of leveraged bonus depreciation.

The fund will invest primarily in gas stations and convenience stores that qualify as Retail Motor Fuel Outlets under the U.S. tax code. By qualifying as Motor Fuel Outlets, the fund is eligible to utilize bonus depreciation to create passive losses. This allows investors in the fund to potentially offset taxes on passive gains. This tax strategy – according to InCommercial – would be an ideal solution for cash flow from a portfolio of real estate holdings, the sale of a business, or resolving a stalled 1031 exchange.

The fund will be offered to accredited investors pursuant to Regulation D, Rule 506(c) under the Securities Act of 1933.

“With all the changes in the retail sector, the opportunities for investment in the convenience and gas sector has never been greater and we’re very excited to combine these strong fundamentals with very compelling tax advantages for qualified investors,” said Erik Conrad, chief executive officer for InCommercial.

Since the launch date of the fund, InCommercial has reported that it is proceeding with its first acquisition – a Chevron in Houston, to be operated by one of InCommercial’s existing operators. Consistent with its investment strategy, the fund will utilize a sale/leaseback transaction to acquire the property and simultaneously lease it under a 20-year, triple net lease to an established operator.

“We are thrilled to be able to continue to support our tenant’s growth in the very competitive Houston market, as well as the potential benefits to all of our investors for this well-positioned property,” said Andrew Haleen, acquisitions director for InCommercial.

The fund has entered into a managing broker-dealer agreement with JCC Capital Markets LLC. The fund will seek to offer shares through both the independent broker-dealer and registered independent adviser channels.

“On the heels of a successful capital raise and execution of acquisition for the InCommercial Motor Fuel Fund II, LP, we look forward to working with our incredible group of [investment banking division] and RIA partners for Motor Fuel Fund III, LP,” said Dan Mercer, Jr., senior vice president of capital markets for InCommercial.

InCommercial is a full-service, end-to-end investment real estate portfolio manager with deep subject matter expertise. Through a 20-year history, its experienced team is dedicated to creating demonstrable value by leveraging their long-standing industry relationships to attempt to create value at each step of the investment cycle starting at acquisition and continuing through streamlined operations, accretive financing, and efficient exits.

Read the full article on DI Wire here:

https://thediwire.com/incommercial-launches-motor-fuel-fund-iii-offering/

Whitepaper: Tax Efficient Investing [Updated Jan. 2024]

InCommercial announces the released update of its whitepaper titled: Tax Efficient Investing – Maximizing the Efficiency of Depreciation.

The whitepaper discusses tax-efficient investing using bonus depreciation, applicability, and usage in today’s market.

Written by Erik Conrad, CEO of InCommercial Property Group.

Download Whitepaper: Tax Efficient Investing [Updated Jan. 2024]

Introduction:

Continuing in the path of 2022 and 2023, 2024 is anticipated to be a difficult time to be an investor in any asset class. Inflation, the great destroyer of wealth, is receding with prices still high along with uncertain economic conditions. Taxes, always a concern for the sophisticated investor, seem only set to rise. That challenging backdrop is met with potentially falling corporate profits, stock market volatility, and declining rental rates in many markets.

To excel in 2024, an investor will have to make smart choices to invest in assets that produce durable income, backed by strong companies in resilient industries while being mindful of how to protect those gains from today’s challenges – including dilution from rising taxes.

Read the full whitepaper HERE: Tax Efficient Investing [Updated Jan. 2024]

Disclaimer:

InCommercial Property Group and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. As mentioned throughout this presentation you should consult with competent, independent, tax representation before engaging in any transaction.

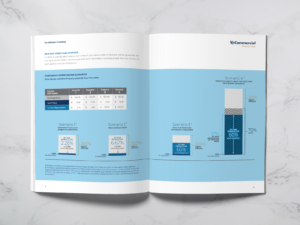

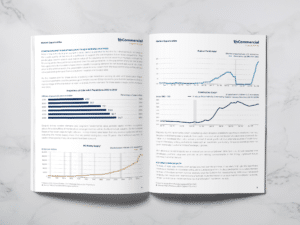

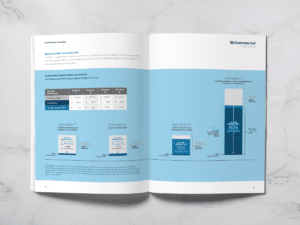

Whitepaper: Market Opportunities

InCommercial announces the release of its latest whitepaper titled: Market Opportunities – Capitalizing on Current Conditions while Hedging Risks.

The whitepaper discusses build-to-suit development strategy, key risks, opportunities, and underwriting in today’s market conditions.

Written by Erik Conrad, CEO of InCommercial Property Group.

Download Whitepaper: Market Opportunities

Introduction:

A “Build to Suit” or “BTS” development is one wherein a commercial property tenant enters into an agreement with a developer or landowner to construct a new, purpose-built facility for the tenant tied to a long-term lease commitment from the tenant once completed. Build to Suit development opportunities are historically amongst the market’s most popular as well as the most limited investment opportunities. Once an investor understands and appreciates the nature of a build to suit development cycle it becomes apparent why, particularly in bull markets, the opportunity to invest in the build to suit space is limited to long-term market insiders.

Build to Suit developments seek to eliminate the speculative variables that accompany most development projects with the largest and most obvious being entitlements and lease-up. The additional certainty from eliminating these substantial risks compresses the development timeframe and drives attractive annualized returns comparable (on an IRR basis) to more speculative investments.

Sophisticated institutional investors and lenders have traditionally crowded out individual investors in this sector because of the high relative risk-adjusted returns and predictable, repeatable business opportunities afforded. The recent monetary tightening, combined with the persistently slower velocity of capital within the commercial real estate market (a result of the Federal Reserve’s efforts to reduce inflation), has resulted in opportunities for investors to capture a share of this attractive development sector and secure long-term gains that are not generally otherwise available.

Read the full whitepaper HERE: Market Opportunities

InCommercial Hires First Wholesaler to Capital Markets Team

InCommercial Property Group, an investment-focused real estate company, announced it has hired Dan Mercer Jr. as the Senior Vice President of Capital Markets.

Dan will be responsible for capital-raising efforts of InCommercial’s investment products such as DSTs and Private Real Estate offerings, through the Independent Broker-Dealer and RIA channels,

“Adding Dan to our growing Capital Markets team will be a huge benefit as InCommercial continues to expand its investment offerings,” James Shaw, President at InCommercial, said. “We are grateful for Dan’s experience within the independent broker-dealer space with registered reps and RIAs.”

Dan has 13 years of experience in capital markets and 20 years in the commercial real estate and development industry. Dan previously worked for companies including KBS, Caddis Capital Investments, and most recently Kingsbarn. Over his tenure, Dan has worked to both develop and raise capital for investment offerings in Retail, Office, Debt, Private Equity, Manufactured Housing, Managed Duration, Mortgage-Backed Securities, and Asset Based Lending & Securitization.

He attended the University of Arizona in Tucson, AZ.

Please join us in welcoming Dan Mercer Jr. to the InCommercial team!

Read the Biz Journal People on the Move feature here: bit.ly/3CgKxEl

Spring 2023 Due Diligence Event In The Books

InCommercial hosted its 1st off-site due diligence event in Scottsdale, AZ and it was a huge success!

KICKING OFF THE EVENT

Even with the unexpected rainy weather, our unwavering leader, Erik Conrad, took a group of diehard hikers for a great trek up Camelback Mountain to kick off the event. The group hiked up the Echo Canyon Trail and made sure to check out the Hidden Cave about 0.8 miles up the trail. It was cloudy but the group was still able to take in some amazing views. Those out opted out of the hike enjoyed lunch and a meet and greet with the rest of the InCommercial team.

PRESENTATIONS

Presenters covered topics from real estate market insights, investment philosophies and the impact of the tax code on various investment strategies. The expert panel provided insights on challenges they have overcome to be more successful in today’s market and the benefits of having a development partner, like InCommercial. Last but not least, an entertaining and educational video presentation was also played showing the importance of properties to their respective communities.

DINNER, NETWORKING & BASEBALL

It’s not all work and no play. The group enjoyed a lovely evening outside at the resort for cocktails, dinner, and networking. Another excursion included visiting the Salt River Fields to watch a spring training ballgame.

THANK YOU

Thank you to all the attendees, expert panelists, and presenters – your presence made our event great. Spending time with knowledgeable industry professionals, having thought provoking conversations, and making meaningful connections was priceless.

Kudos to the InCommercial team who made it all happen! Tiffany Fraley, JoAnn Saguto, Karla Lombardi, CPA, Michael Woldman, Meggie Jenkins, and Angela Gallik.

Big thanks to the staff at The Scottsdale Plaza Resort & Villas, who went above and beyond to support our team and made our guests feel special and taken care of.

Whitepaper: Tax Efficient Investing

InCommercial announces the release of its latest whitepaper titled: Tax Efficient Investing – Maximizing the Efficiency of Depreciation.

The whitepaper discusses tax-efficient investing using bonus depreciation, applicability, and usage in today’s market.

Written by Erik Conrad, CEO of InCommercial Property Group.

Download Whitepaper: Tax Efficient Investing

Introduction:

Continuing in the path of 2022, 2023 is thus far proving to be a difficult time to be an investor in any asset class. Inflation, the great destroyer of wealth, is proving stickier and far less “transitory” than anticipated, and taxes, always a concern for the sophisticated investor, seem only set to rise. That challenging backdrop is met with potentially falling corporate profits, stock market volatility, and declining rental rates in many markets.

To excel in 2023, an investor will have to make smart choices to invest in assets that produce durable income, backed by strong companies in resilient industries while being mindful of how to protect those gains from today’s challenges – including dilution from rising taxes.

Read the full whitepaper HERE: Tax Efficient Investing

Disclaimer:

InCommercial Property Group and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. As mentioned throughout this presentation you should consult with competent, independent, tax representation before engaging in any transaction.